Join each day information updates from CleanTechnica on e mail. Or observe us on Google Information!

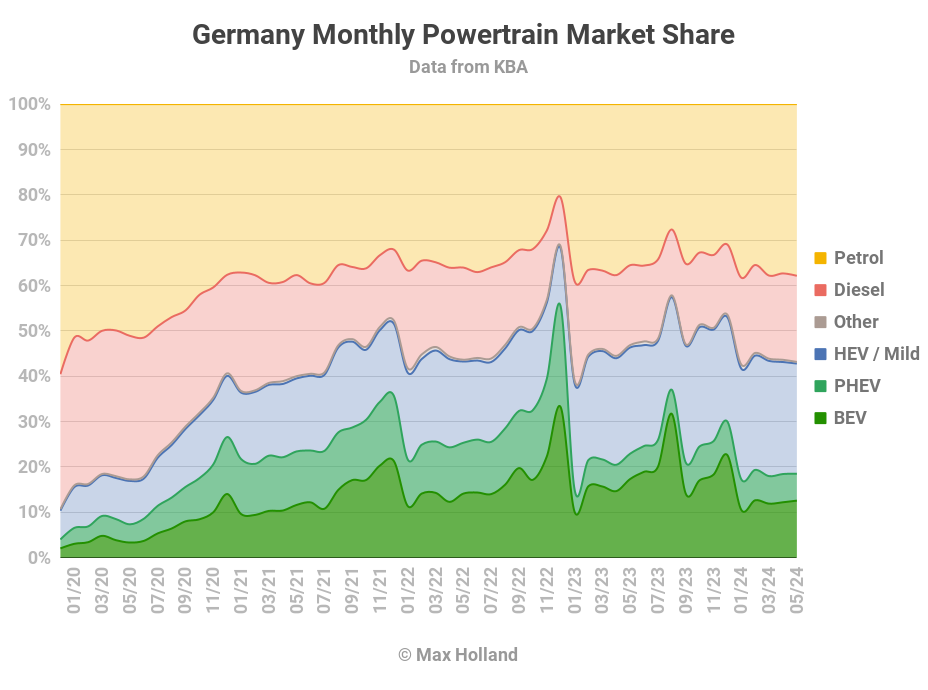

Could noticed plugin EVs at 18.5% share in Germany, down from 22.9% in Could 2023, in a seamless hangover from the sudden incentive abandonment in late December. BEVs had been down some 31% in YoY quantity, whereas PHEVs had been up 2%. General auto quantity was 236,413 models, down 4% YoY, and down 27% from 2017–2019 seasonal norms (~325,000 models). The most effective promoting BEV in Could was the Volkswagen ID.3.

Could’s gross sales figures noticed mixed EVs at 18.5% share, with full electrics (BEVs) at 12.6% and plugin hybrids (PHEVs) at 5.9% share. These evaluate with YoY figures of twenty-two.9% mixed, with 17.3% BEV and 5.6% PHEV.

The fallout from the abrupt cancellation of BEV incentives in mid December continues. Relative to costs earlier than the cancellation, BEVs are dearer now, and are perceived as dearer, for the reason that change is firmly inside reminiscence. The concept of paying extra for a similar factor is clearly holding individuals again. If BEVs had been roughly value aggressive with different powertrains, of us is perhaps ready to swallow a modest bump in BEV costs, however that’s not the case.

The Fiat 500 BEV (€34,990) is over twice the worth of the combustion mild-hybrid model — a value premium of €17,500! On condition that EV battery cells are actually priced at €49 per kWh, a 42 kWh battery pack want value not more than €2,700. The rest of the BEV powertrain (motors, energy electronics, and so on.) ought to value much less nonetheless (so, beneath €5,400 in sum). Then there’s the saving of round ~€2,000 on the foregone ICE powertrain. The fee premium of the BEV variant over the mild-hybrid ought to thus be lower than €3,400. Why is Stellantis charging €17,500 extra for the BEV? #FootDragging.

Germany’s financial scenario is just not serving to both, with formal recession current in Q1 and This fall prior. Of us are likely to keep away from buy choices perceived as costly throughout a recession — and most BEVs are perceived as costly.

All of those elements are combining to place a squeeze on BEV purchases, relative to different powertrains, and thus we’re seeing BEV quantity drops, and lack of share, this 12 months. 12 months so far 2024, cumulative BEV share now stands at 12%. At this level in 2023, it stood at 15.0%. That’s a YoY shrinking in BEV share of 20%, in Europe’s largest auto market — not excellent news for the transition in Europe.

In the meantime, China’s BEV share has grown to 26% (newest information till April YTD), from 23% 12 months on 12 months. If we embody EREVs and PHEVs, China’s YTD plugin share (to April) is 40%, whereas Germany’s is simply 18%.

Could noticed combustion-only powertrains in Germany growing their share YoY. Diesel-only elevated to 19.0% share (from 17.6% YoY). Petrol-only elevated to 37.9% (from 35.5%).

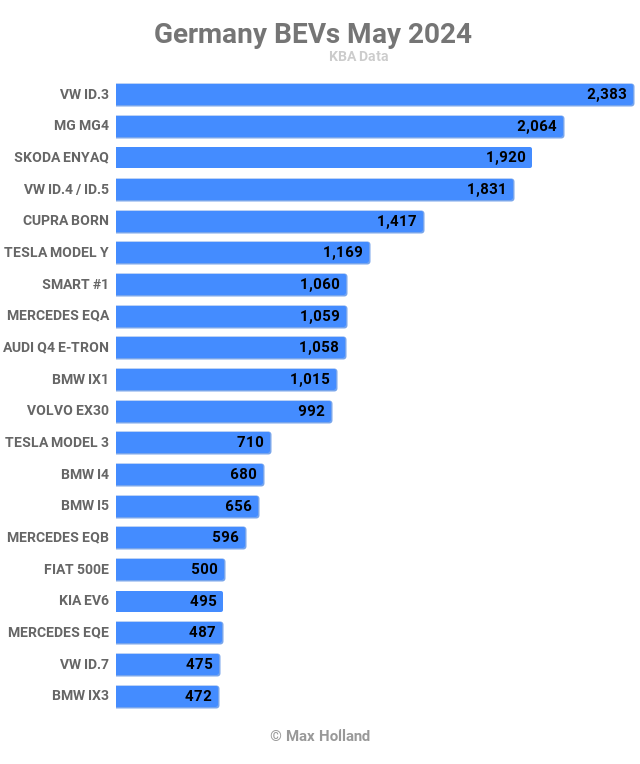

Finest Promoting BEV Fashions

The most effective promoting BEV mannequin in Could was the Volkswagen ID.3, with 2,383 models. That is the primary time the ID.3 has taken the highest spot since August 2021. Welcome again.

In second place was the MG4, with 2,064 models. The Skoda Enyaq took third, with 1,920 models.

The MG4’s second place end repeats its earlier finest rating from February, however with a private finest quantity — up 120% YoY. Though mid-month of quarter is the everyday MG4 transport peak into Germany, among the quantity can be seemingly diverted from the French market, the place in style non-European fashions just like the MG4 have not too long ago misplaced entry to the eco-bonus.

I don’t have any rationalization for the ID.3’s uncommon push to the highest spot, besides maybe that it’s extra inexpensive than most different MEB automobiles, so the recession could also be giving it (relative) favour. Its Could quantity of two,383 models is 9% up YoY. The ID.4/ID.5 quantity (1,831 models) was lower than half that of a 12 months in the past (3,720 models). Supporting this “select the cheaper MEB” speculation is the truth that the Cupra Born was additionally up in quantity, by 28% YoY, and the Audi This fall e-tron was down by 36% YoY.

The Sensible #1 additionally did comparatively effectively in seventh, a private finest rank, up from tenth in April. Its sibling, the Volvo EX30, can be now secure in or close to the highest 10, at eleventh in Could.

As for brand new arrivals on the German market, Could noticed 5 debutants. The brand new Peugeot 3008 noticed its first deliveries, 67 models. See the Sweden report for extra particulars on this new mannequin (on a brand new platform).

Subsequent up was the brand new BYD Seal U, an SUV brother to the Seal sedan. It noticed an preliminary 31 deliveries in Could. This can be a Tesla Mannequin Y competitor, however priced a bit decrease, from €42,000 vs. €45,000 for the Tesla. Extra particulars are within the Sweden report.

On the similar value because the Seal U, a modern new sedan from GWM Ora has arrived (10 preliminary models), known as the ORA 07, with a form paying homage to a Porsche Panamera. These 10 models could also be supplier samples for now — we are going to regulate it.

Lastly, the Mercedes-Benz G-Wagon BEV noticed 6 preliminary models registered in Could. Marketed because the “Mercedes G 580 EQ,” that is an costly retrofit of the traditional G-Wagon boxy SUV form which has been round for the reason that Seventies. Priced from €143,000 in Germany, this new electrical variant gained’t transfer the needle on BEV volumes, and hasn’t usurped the petrol and diesel variants — although, could displace a few of their gross sales.

Xpeng registered 5 models of the P7 sedan in Could (see Maarten’s evaluate for extra about this mannequin). The P7 has been round at modest volumes in Europe for a few years already — these 5 models could also be an preliminary testing of the waters within the essential German market. We are going to regulate it.

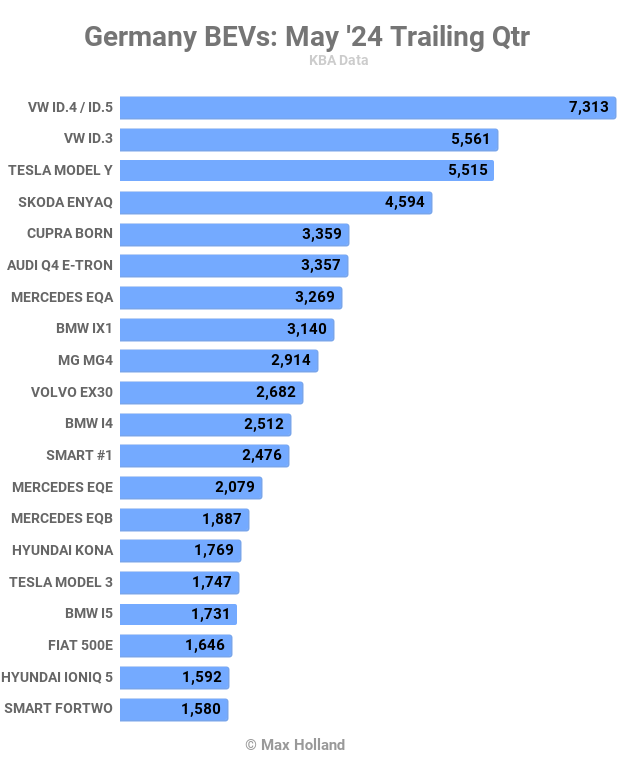

Let’s see what’s taking place in the long run rankings:

The Volkswagen ID.4/ID.5 is within the lead, a great enchancment from the third place it took within the prior 3-month interval (December to February). This mannequin has barely been out of the month-to-month high three in additional than a 12 months.

Because of robust efficiency in Could and April, the VW ID.3 has climbed to second place, from tenth place prior. Its quantity has climbed 88% over the interval.

In the meantime, the Tesla Mannequin Y has fallen to third place, from 1st within the prior interval, with quantity falling by 48%. Let’s see how a lot floor it’s going to recuperate within the end-of-quarter push in June.

The most important climber within the high 20 chart is the Volvo EX30, which — after debuting again in December — has arrived in tenth place, from twenty ninth within the prior interval. There’s each probability that the younger Volvo can climb one other couple of spots over the approaching months.

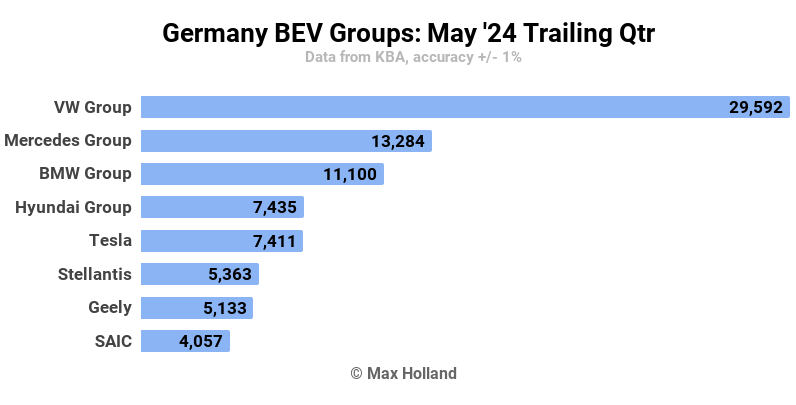

Let’s shortly have a look at the manufacturing group rankings:

Right here Volkswagen Group is clearly nonetheless holding its floor, and share has truly elevated to 33% of the BEV market, from 27% prior (December to February).

Mercedes Group has climbed strongly over the interval, growing share from 11% to 14.8%. Its shut rival, BMW Group, dropped a spot to third, and misplaced share from 14.6% to 12.4%.

Tesla misplaced share from 12.7% to eight.3%, dropping from third to fifth. Stellantis misplaced share from 11.8% to six.0%, falling from 4th to sixth. Thanks partially to the success of the Volvo EX30, Geely has now elevated share from 3.5% to five.7%, and climbed from ninth to seventh, overtaking SAIC, whose share remained flat.

Outlook

The 4% decline in auto gross sales 12 months on 12 months is consistent with the broader financial local weather in Germany, with Q1 information displaying damaging 0.2% financial development 12 months on 12 months, from a This fall determine additionally of -0.2%.

Inflation has crept again as much as 2.4% in Could, from 2.2% in April. ECB rates of interest fell to 4.25% in early June, from 4.5% prior. Manufacturing PMI improved to 45.4 factors in Could, from 42.5 factors in April.

Increased inflation is just not going to assist shopper pocketbooks. I’ll repost the assertion that was made final month by the auto trade affiliation VDIK: “the decline in absolutely electrical automobiles that has been noticed for the reason that starting of the 12 months is changing into extra pronounced. The BEV phase is presently struggling a disaster of confidence, which was primarily attributable to the choice to abolish the electrical bonus at quick discover.” [Machine translation.]

As mentioned above, I’d add excessive BEV costs, and the weak economic system, to the checklist of damaging influences.

What are your ideas on Germany’s auto market and the transition to EVs? Please soar into the feedback part under and be part of the dialogue.

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.